The world’s most ‘adventure-friendly’ airlines

Traveling is different when you have a taste for adventure.

Whether it’s hauling lots of technical gear, booking a complicated itinerary to a far-flung destination, or deciding to travel at the last minute because the swell or snowfall just happens to be epic—adventure travelers are always willing to go the extra mile (or much more) for that unforgettable trip.

But traveling with adventure in mind means that you most likely have a different set of priorities when deciding which airline to book with. Whether you’re a surfer, mountain biker, or scuba diver, you may find yourself navigating complicated baggage policies, struggling to to stay within your chosen frequent flier program for a multi-leg trip, or searching for an airline that flies to that niche destination on your bucket list.

As Eric Larsen, a polar adventurer based in Crested Butte, Colorado, put it: “I’ve had so many crazy experiences with baggage—baggage check is one of the most stressful aspects of travel for me … especially when I’m flying solo and I have five or six bags in the airport. Usually, I’m working so hard, I’m sweating.”

So how does Larsen manage to keep his cool when he’s lugging polar sleds through the airport on his way to an Arctic expedition?

“I try to stick with one airline [alliance] or group so that I accumulate points and status, which not only makes checking in with a lot of bags easier, but it means that my bags are also offloaded first. With ‘status’ you also get extra bags and even extra heavy bags.”

As Larsen suggests, what travelers bound for adventure tourism destinations really need is customization and flexibility, whether it be in their airline’s baggage policies and route map, or their travel insurance provider’s a la carte policy benefits.

carriers that best suit your needs

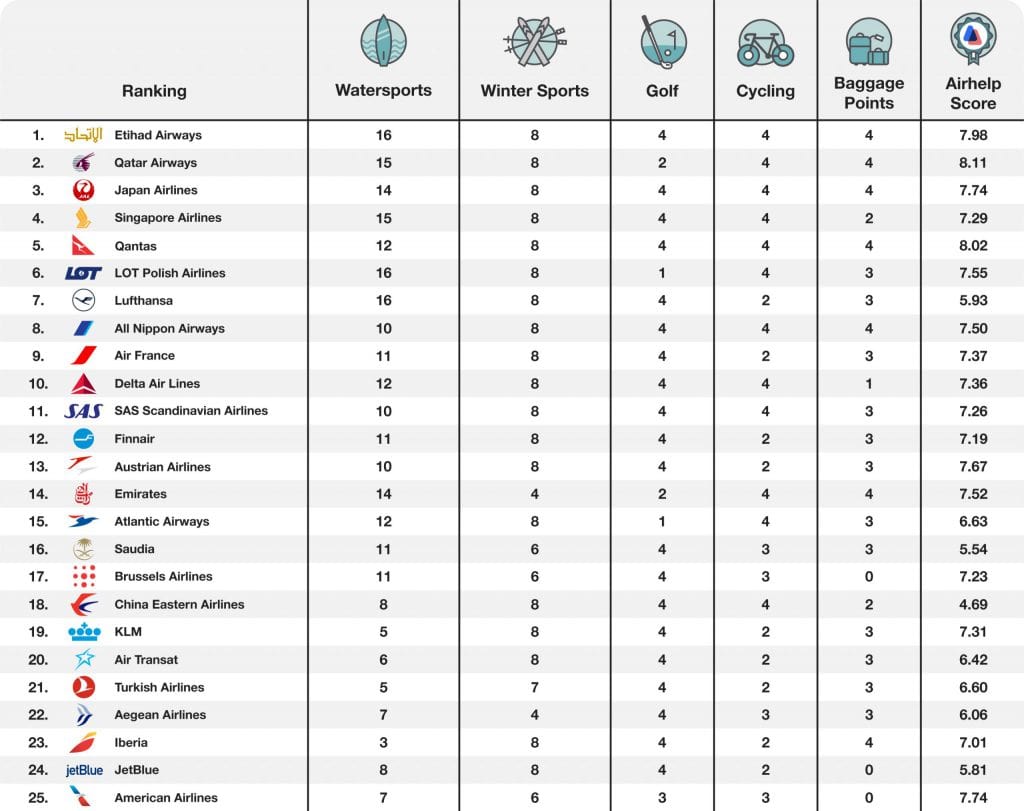

As the leading provider of insurance for travelers going to adventure destinations, battleface ranked the top 25 most adventure friendly airlines to help travelers find the carriers that best suit their needs, looking at adventure destinations served (those best known for adventure sports and activities), baggage policies, alliance membership, and more.

Here’s a peek at the 25 adventure travel airlines that made the list. Read on for a deeper look at why the top 10 airlines on the list came out on top.

The Top 10s

1 Etihad Airways

Etihad flies to nearly all the top destinations in the world for adventure sports including ski/snowboarding, mountaineering, scuba diving, kitesurfing, sailing, kayaking, surfing, sailing, and mountain biking. It also has one of the most generous baggage policies, with two free checked bags and allows for a range of sports equipment—including bikes, kayaks, skis, and snowboards—in its standard baggage allowance, making it the best airline for bikes, among other activities.

2 Qatar Airways

Qatar services the top destinations for all nine sports and activities included in the survey, including golf, the one which Etihad lacks. It also allows for a generous baggage allowance of two checked bags per passenger on an economy ticket. As part of the OneWorld Alliance, it’s an attractive option for frequent fliers within that network.

3 Japan Airlines

Japan Airlines also generously allows a range of sports equipment—bikes, kayaks, skis/snowboards, scuba gear etc—to be included as part of its standard free baggage policy. Plus, it flies to all but one of the top destinations for the nine sports on the list.

4 Singapore Airlines

Part of the Star Alliance network, Singapore Airlines has a generous weight-based baggage policy—versus one defined by individual items—which means you can apply any sports or adventure equipment you’re checking in towards your overall baggage weight allowance.

5 Qantas

One of the airlines in the top ten that are part of the OneWorld alliance, Qantas allows for two free checked bags on an economy ticket, and serves eight of the nine destinations for the chosen sports and activities. It’s another airline on the list that allows you to check a bike as part of your free baggage allowance, too.

6 LOT Polish Airlines

Like Etihad, LOT Polish Airlines is another carrier that includes equipment like bikes, kayaks, scuba gear and skis/snowboards in its free checked baggage allowance, making it an attractive option for adventure travelers who are hauling gear. It’s also part of the expansive Star Alliance network.

7 Lufthansa

Lufthansa is another airline on the list that services the top destinations for all nine included sports and activities. It ranks number two on the list for airlines that are friendly to golfers, and is also part of the Star Alliance network.

8 All Nippon Airways

ANA – All Nippon Airways – is the largest airline in Japan and scored well for both Winter Sports and Cycling, alongside having a generous baggage allowance for adventure sports enthusiasts. ANA is a member of the Star Alliance network and is renowned for attentive service.

9 Air France

The flag carrier of France, Air France is a founding member of the SkyTeam global alliance, and has codeshares with a number of other airlines, making destinations around the world easier for travelers to fly to. It has attractive baggage allowances for those heading to the slopes – with skis being free as part of your baggage allowance.

10 Delta Air Lines

Also referred to as Delta, Delta Air Lines is headquartered in Atlanta, Georgia, and is one the world’s oldest airlines in operation. Delta scores highly for both golf and cycling, is a member of Skyteam Alliance, and has codeshare agreements with a number of quality airlines, including LATAM, Aeroméxico, Garuda Indonesia and Aerolíneas Argentinas, allowing for easier connections for more far-flung adventure friendly destinations.

Methodology

Read more below on the specific approach and methodology.

Read more below on the specific approach and methodology.

The world’s most adventure friendly airlines study was created with a rigorous methodology.

- Using the sources below, we created a list of the top global destinations for each of the nine “adventure travel” activities that battleface provides coverage for. Those activities are: Surfing, sailing, kitesurfing, golfing, kayaking/canoeing, scuba diving, mountaineering/trekking, mountain biking, ski/snowboarding

- We then triangulated the closest airport(s) that served those top nine adventure activity destinations

- We pulled all airlines servicing those airports

Then airline data pulled included the following:

- Baggage fees, weight, size, (maximum sizes and weights) and first bag fee for economy, or standard economy equivalent standard fare

- Special items considerations for each activity: Whether the items would be accepted, whether they are included in baggage allowance or will be under a special item/excess baggage charge, what the charge is for any overages or special cases based on fare type. To create a shortlist from over 700 airlines, points were then allocated based on the number of adventure activity destinations serviced by the airline. The top airlines (just over 100) from this were then allocated points relating to the data pulled above (baggage, adventure destination, special items consideration, alliance membership) and the top 25 airlines ranking was created

- Airhelp 2022 Global Airline Ranking scores were used to highlight the quality of service offered by the airlines

- We categorised the nine “adventure travel” activities into four main sports types: watersports, winter sports, golf, and cycling